This year, Starbucks launched its full fall menu, including the signature Pumpkin Spice Latte (PSL), on August 22nd—two days earlier than their 2023 launch and the earliest since the PSL’s debut in 2003.

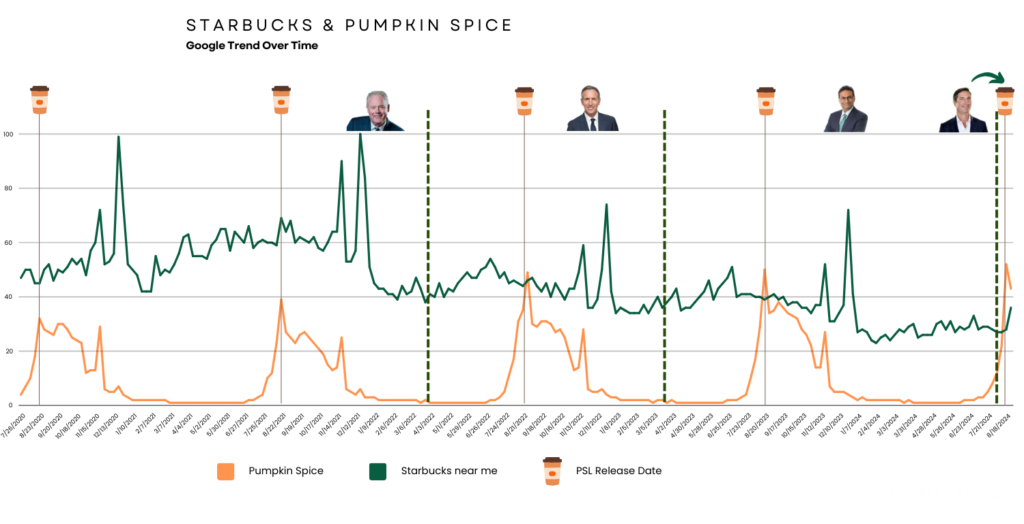

The graph above, generated using data from Google Trends, illustrates the surge in Google searches for “Pumpkin spice” compared to “Starbucks near me”. While “Starbucks near me” serves as a general indicator of consumer interest in Starbucks locations, it doesn’t perfectly isolate the impact of the PSL release since it could be influenced by various other factors, such as promotions, new store openings, or even regional variations in consumer behavior. Despite these limitations, it provides a valuable baseline to help contextualize the specific spike in PSL searches surrounding its release. The sharp increase in PSL searches surrounding its release is evident nonetheless.

Why Release the Pumpkin Spice Latte Early?

There are several potential reasons for Starbucks’ decision to release the PSL earlier this year, including but not limited to an extended sales window, beating competitors to market, and new leadership.

Extended Sales Window

The PSL is a significant contributor to Starbucks’ earnings. According to Nielsen, sales of pumpkin spice-related products exceeded $800 million in the 12 months ending July 2023. Starbucks alone sells 20 million Pumpkin Spice Lattes each year, with roughly 10% of its overall sales coming from seasonal staples. Extending the sales window for these products could lead to increased revenue.

Beating Competitors to Market

When Starbucks first introduced the PSL, it was a unique offering. However, many competitors now have their own versions, including Dunkin’, Krispy Kreme, Dairy Queen, Smoothie King, and Wendy’s. Nielsen reports that there are over 3,000 pumpkin spice products on the market today. To maintain their stronghold on the fall menu market, Starbucks might be aiming to be the first to market to avoid being overtaken by competitors. By launching the PSL earlier, they ensure that they set the seasonal trend, reinforcing their dominance and preemptively capturing consumer attention before other brands can enter the scene.

New Leadership

Starbucks has been navigating a period of declining sales coupled with a sudden change in leadership. Last week, the company announced that Brian Niccol, the CEO of Chipotle and a renowned corporate turnaround specialist, will assume the role of chairman and CEO. The intense media focus surrounding Niccol’s appointment can be strategically advantageous, as heightened visibility often translates to increased consumer and investor interest. This makes it an opportune moment for launching new products, such as the PSL, which can leverage the media buzz to amplify its impact.

Moreover, a new CEO’s inaugural earnings report is critical for shaping investor perception on Wall Street and for setting the tone for their tenure. Academic research on corporate finance suggests that long-tenured CEOs are generally less inclined to pursue significant changes, whereas new CEOs often seek to make their mark through bold initiatives. By advancing the PSL release, Niccol might be signaling a willingness to implement fresh strategies and a proactive approach to revitalizing Starbucks’ market presence. This early product launch could thus serve as an early indicator of how Niccol plans to drive change and how receptive Starbucks’ upper management will be to these new strategies.

Ready Signal

At Ready Signal, we understand that an earlier release date alone doesn’t guarantee a boost in sales. Our market intelligence platform is designed to help companies, such as Starbucks, test and identify the unique leading indicators from the macro environment.

By analyzing Google Trends data through our Ready Signal Recommendation Engine, we’ve identified three key leading indicators that, when compared to historic data, could give Starbucks additional insights into the factors that drive their sales:

- Civilian labor force by state

- Existing home sales (not seasonally adjusted)

- CPI for medical care commodities in the U.S. city average

Starbucks could then seamlessly integrate these features into their predictive models which can quickly help them understand the impact of these factors on their past performance so they can build better predictive models for future planning.

If you’d like to see how this might work in your business, please let us know!